The longer the world’s central banks continue to experiment with negative interest rates, the better the outlook for gold, according to Britain’s biggest bank, HSBC.

In the bank’s daily update on the state of the precious-metals industry, HSBC points to a recent report published by the Bank of International Settlements, often known as the central bank for central banks.

The BIS’ report said predicting what would happen if negative rates were to fall even further, and become more widespread, was particularly difficult, and that uncertainty, HSBC says, is great news for investors in gold.

Here’s James Steel, HSBC’s chief precious-metals analyst (emphasis ours):

How does this play out for gold? Positively we think. The imposition of negative rates is a sign of distress, which is gold-bullish. Furthermore, the uncertainty surrounding the long run impact of negative rates as outlined in the BIS report is also supportive of gold. The BIS report seems to say that negative rates have brought uncertainty, especially as regards their impact on financial intermediaries, but have not delivered hoped for gains for households and businesses. This is to gold’s benefit.

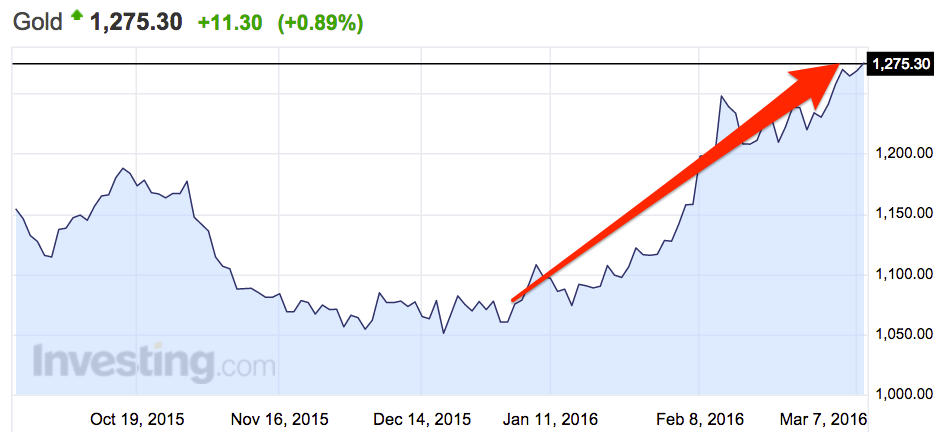

The price of gold has rallied massively in 2016, gaining nearly 19% in value since the start of the year. It is trading at just less than $1,275 an ounce, its highest level since early last year. Here’s how that looks:

Much of gold’s rally is due to the huge volatility in financial markets earlier this year. Investors traditionally pour money into gold during times of trouble, something that was particularly true in January and February. At one point in February, investors were buying gold at levels not seen since the time of the financial crisis.

source: http://uk.businessinsider.com, Will Martin ,Mar. 8, 2016,